Monday, December 31, 2012

IRAs: Saving and Investing For Your Retirement

There are several types of IRA's, but in this post I will focus on the two most popular ones, the traditional and the Roth IRA. So what is an IRA? IRA is an abbreviation for Individual Retirement Account. It is similar to a savings account, but unlike a regular savings account, an IRA provides huge tax benifits. You can open an IRA at a bank, brokerage firm or any financial institution. Anyone under age 50 can put up to $5000 per person into an IRA every year. If you are 50 or older you can contribute up to $6,000 per person every year due to a catch-up provision.

A Traditional IRA will allow you to put before-taxed (or tax-free) money into it for retirement. If you decide to invest the money that's saved in your IRA into stocks, bonds, or a mutual fund you will not be taxed on your earnings from those investments either. However, upon withdrawal you'll have to pay taxes on both the money you deposited and your investment earnings.

A Roth IRA allows you to put after tax money into it for retirement and you can also invest the money inside your IRA into stocks, bonds, mutual funds, etc. However, unlike a traditional IRA, your investment earnings will never be taxed as long as you leave your investment earning in your IRA until age 59 1/2. Also, once you've deposited your money into any IRA, if you try to pull out your money or your investment earnings before age 59 1/2 you will pay a 10% early withdrawal fee. Below is a list of pros and cons to help you decide wether or not placing your money in an IRA will benefit you.

ROTH IRA

Pros

- You can withdraw your investment earnings tax

-free when you are at least 59 ½ yrs. of age or your beneficiary can after your death.

- Unlike the traditional IRA, you are not required to make withdrawals even after the age of 70½. You can keep the money in your account for as long as you like.

- You can withdraw all the money you deposited tax

-free because you pay taxes on that money before you put it In

- A Roth IRA can be inherited. Your beneficiaries can make withdrawals after your death.

- There is no age limit to be able to contribute to Roth IRA.

Cons

- You have to pay taxes on your money before putting in a Roth IRA, which gives you less money to invest with.

- The annual maximum deposit limit is $5000 for those below 50 yrs. old and $6000 for those above 50

-You will have to pay a 10% fee if you are going to make withdrawals before you are 59½ yrs. old.

TRADITIONAL IRA

Pros

- You can put money into this IRA before you pay taxes on It.

Cons

- Withdrawals of your deposits and investment earnings are considered as income and will be taxed.

-You will have to pay a 10% fee if you are going to make withdrawals before you are 59½ yrs. old.

-The annual maximum deposit limit is $5000 for those below 50 yrs. old and $6000 for those above 50.

-You are required to start making withdrawals whether you want to or not at the age of 70 1/2.

-No more deposits can be made after age 70 1/2.

Edited by Reginald Forest

Retirement Calculator

Friday, December 28, 2012

Make Money Work for You (Investing in Money Market Accounts)

What is a Money Market Account?

A Money market account is a saving account offered by banks and credit unions. It's similar to a traditional saving account because its safe and will pay you interest on your money. However, a money market account will normally pay you more interest then a traditional savings account. Also unlike a traditional savings account, money market accounts usually offer check-writing privileges.

Money market accounts tend to require you to maintain a minimum monthly balance and have initial opening deposit anywhere from $1,000 to $25,000, which is higher then the average traditional savings account. Interest rates on money market accounts and saving accounts differ from area to area. My advice is to shop around and compare rates so that you can make an informed decision on whether or not placing your money in a money market account is the right choice for you. Below I have included a list of pros and cons :

Pros

-Funds in money market accounts are easy to liquidate and can be withdrawn as cash or transferred to other accounts.

-Money market accounts are a safe investment because they are insured by the FDIC up to $250,000.

-Money market accounts earn higher interest than savings accounts.

-Money market accounts are a good option for retirees or investors who prefer to earn a high interest on their money with the least possible risk, while maintaining direct access to their funds and being insured against loss

Cons

-Money market accounts allow only a few withdrawals per month.

-If the money market account falls below the minimum required balance, or it exceeds the limited number of transactions, you'll have to pay a fee.

-A money market account typically requires a higher minimum balance than a savings account, and will penalize you if it drops below the minimum.

-some MMA pay a monthly fee

Related Searches:

Make Work for You (Investing in Stocks Online)

Make Money Work for You (Franchising)

Make Money Work for You (Investing in Bonds)

Make Money Work for You (Starting a Small Business)

Make Money Work for You (Investing in Mutual Funds

Thursday, December 27, 2012

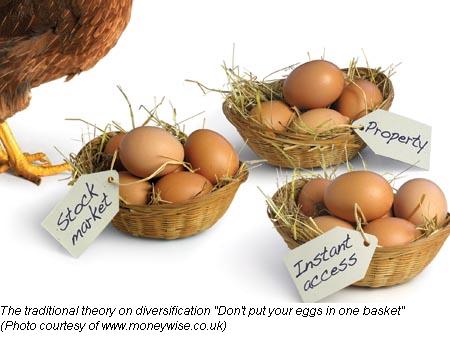

Financial Food for Thought (Diversification)

What is Diversification?

In the investment world, diversification means to invest your money into a variety of investments to help reduce risk. Which means you should never place all of your eggs (money) in one basket (investment) because if something negative happens to that basket (investment) then you'll lose everything (all your money). Instead you should diversify your investment portfolio by investing in a variety of investments such as stocks, real estate, bonds, etc.

Unfortunately the average person don't have enough money to invest into a variety of investments. However, this is why mutual funds were created. A mutual fund will give an average person with a small amount of money an opportunity to invest into a diversified investment portfolio. If you would like to create a diversified investment portfolio but you don't have a lot of money, please visit

Make Money Work for You (Investing in Mutual Funds) to learn more about Mutual Funds and how investing in them can benefit you.

Wednesday, December 26, 2012

Financial Food for Thought (Compound Interest 101)

This is the first time some of my readers have ever heard of compound interest. Just incase my example in my previous post didn't clearly explain compound interest, I've put together a list of definitions and examples from different websites to help me better explain what compound interest is and how it can benefit you.

Example#1

What is compound interest? It's interest earning interest. For example, suppose you saved and banked $100 a year ago. It earned $2 in interest last year. This year, you'll be earning interest on $102 (original savings plus the interest earned). That might not seem like much, but understanding that simple fact can have a major impact on your financial success.

http://money.usnews.com/money/blogs/my-money/2012/09/20/10-things-you-need-to-know-about-compound-interest

Example#2

Compound interest is, in a nutshell, interest upon interest. That is, when an interest payment is added to the principal and then the whole thing (principal + interest) earns interest.

http://wiki.fool.com/Compound_interest

Example#3

The longer you save money, the more it can grow in value due to compound interest. Compound interest means you earn interest not only on the amount you deposit in a savings account, but also on all the interest you earned previously. (Provided you didn't take out any money, of course!)

http://www.cashcourse.org/articles/id/1818/the-power-of-compound-interest--small-savings-add-up

I hope this helped!! Please visit these sites, for further information.

Financial Food for Thought (Compound interest vs Simple Interest)

What is Compound Interest?

Compound interest is interest that is paid on both the principal (the original investment) and also on any interest the principle earns every year. For example, if I received 15% interest on my $1000 investment, the first year and I reinvested the money back into the original investment, then in the second year, I would get 15% interest on $1000 and the $150 (15%) I reinvested. Over time, compound interest will make much more money than simple interest.

What is Simple Interest?

Simple interest is interest paid on the principal alone. Simple interest is called simple because it ignores the effects of compounding. The interest charge is always based on the original principal, so interest on interest is not included.

I'm sure you will agree that investment accounts that compound interest are much more profitable than accounts that simply pay interest on the principle alone.

Saturday, December 22, 2012

Financial Food for Thought (Assets & Liabilities)

A Liability is a debt, financial obligation, or item that loses value or creates an expense while owned, and often a loss is made when its sold. Liabilities can be credit card balances, lines of credit, car loans or other loans, payment plans for purchased items, etc

If you truly want to become financially free or rich, you have to buy more assets than liabilities. You want your personal balance sheet to look like this:

Personal balance sheet

Assets Liabilities

Stocks Loans on which interest has to be paid

Mutual funds Car loan

Business Credit card debt

Bonds

Franchise

Gold & silver

Money market account

You can become financially free or even rich with a balance sheet like this because your income is greater then your output (expenses). Building a personal balance sheet like this won't happen over night. But with patience, self-discipline, and a plan, someday you can have a balance sheet that looks just like this or even better!!

Thursday, December 20, 2012

Financial Freedom 101

If you were suddenly laid-off or stop working today, would you still be able to provide for you and your family for the rest of your life? If you answered yes, then congratulations you're financially free. If you answered no, then this blog was created for you. So don't get all sad and depressed on me just yet, because by reading this you are taking a gigantic step towards attaining your financial freedom.

Through over a decade of research and experience, I have learned that by saving and investing wisely, anyone can achieve financial freedom. My goal is to teach you what I've learned, and hopefully all of you will one day join that elite group of individauls who are truly financially free.

If you would like to learn more about becoming Financially Free please click one of the links or home button below!

Thank you for visiting!!

Popular Searches:

Financial Food for Thought (Budgeting)

Friday, December 14, 2012

The Dollar Report: This is how the declining value of the US dollar is affecting you

Related Posts:

The Dollar Report: U.S. Exports and Imports and How it's affecting you

Wednesday, December 12, 2012

Here's a few tips on how you can start to clean up your bad credit today

Why is it that credit, which is affecting people all across the world, one of the least talked about subjects inside our circles of discussion today? Most of us don't learn about the importance of maintaining a good credit score until our credit has been ruined. At this point, instead of coming up wit a plan to pay off our overdue bills, most of us just set our bad credit reports to the side. Hoping that one day we come across enough money to pay off everything at one time. Unfortunately for most that day may never come. Instead we can start to take action towards cleaning up our credit history today. With the right plan, some patience, and self-discipline you can turn your credit report into something you could be proud of.

Here's a few ideas to help get you started. First you should order a free credit report. Your credit report will give you a list of everyone you've borrowed from and how much you currently owe them. With this info you can start to create a plan of action that will eventually lead to you having a good credit report. Ok now that you know exactly who you owe and how much you owe them. You can contact them to set up a monthly payment plan. Or you can ask if they'll be willing to accept a one time settlement payment, which is normally a lot less then the balance that's being reported. If netheir of these seem like they'll work for you, you could start saving a percentage of your income every month. Then at the end of every year take that savings and go pay something off. Until every delinquent account on your report is paid off.

Of course the choice is yours. You are the only one that truly knows which plan will work best for you. Just don't allow bad credit to lenger in your life any longer without at least trying to repair it.

Monday, December 10, 2012

Would you like to retire at an early age? If you answered yes, then Here's how

In order to retire from work at an early age, you have to have an early retirement plan. I know some of you all's early retirement plan is to win the lottery and live happily ever after. I'm not saying you won't, but just in case you don't. You might want to have another early retirement plan in place.

Putting some money into a 401k, an IRA, or some other high interest savings account every month is a great way to start setting yourself up to retire someday. Would doing that and that alone guarantee you an early retirement? Probably not, but its still a good decision. Just having a traditional saving account with money in it for retirement is better then not having a savings at all.

"So what do I have to do to retire early?" You have to create another source of income outside of what you are already earning as a worker. "And how do I do that?" First you'll need to start a savings account in which you'll put a % of your monthly income. Make sure this % isn't putting to much of a strain on you or your family's happiness. If it is then its probably too much so save less. Then you'll want to start researching investments to put this money into, such as real estate, a franchise, a small business, etc. Once you choose an investment, you want to learn everything you can about it. If you really don't have the time to learn everything, then seek out the advice of people who are already succeeding at whatever it is you want to do. Once you feel comfortable with your investment, and you have enough money in your savings to invest, then invest.

Ok. Sweet. Your investment is doing good. You have extra money Rollin in every month. What are you gonna do with all that new money? "Blow it on a lot of things I've been wanting to buy but couldn't afford too, up until now." I have to admit that does sound like a lot of fun. But instead of blowin it, you could reinvest it and make more money off of that money. Which would increase your secondary income, and the possibility that your dream of retiring early will eventually become a reality.

This was all a dream

It's exciting to see the birth of something I always wanted to create. This is not just a blogg for me. It's a platform from which I plan to share the knowledge that I have acquired throughout my life, and from the numerous books that I have read on handling finances and on becoming successful. I hope to enlighten you with every blog I post. If you like it, please encourage your friends and family members to visit. Without an audience to write to, I might as well post these posting behind my toliet, Because if I'm the only person reading them, it doesn't matter where there posted. Nobody's reading them anyway! In other words, I need your support and I value your feed back. Welcome to Financial Blueprint!!!!